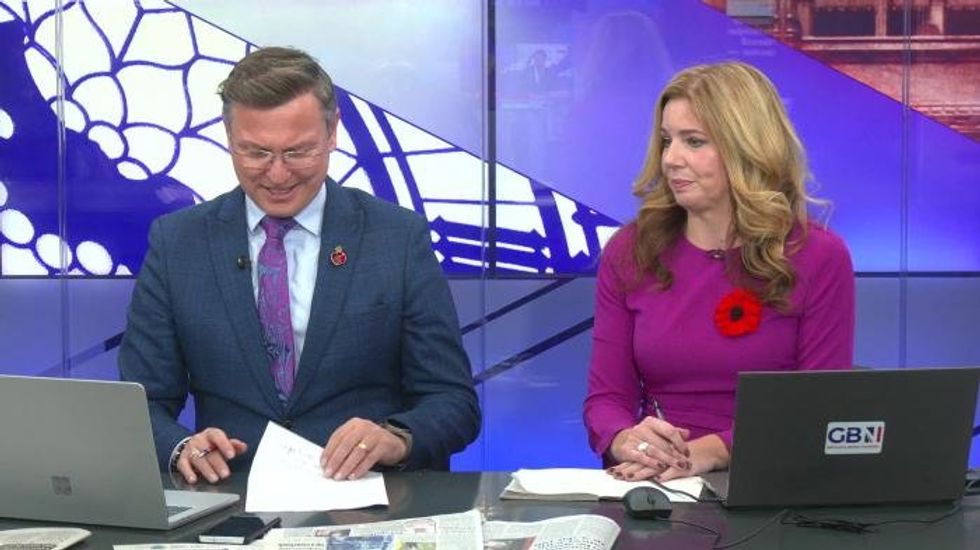

Rachel Reeves raises car taxes for first time in 12 years as certain drivers risk £2,000 cost hike in April

Several MPs have raised serious concerns over Labour's plans to increase Vehicle Excise Duty for heavy goods vehicles this April, warning that certain operators could face costs rising by more than £2,000 annually.

The tax hike, first announced by Chancellor Rachel Reeves in last year's Autumn Budget, will see VED for lorries adjusted in line with inflation from Wednesday, April 1, 2026.

The changes will affect rigid trucks operating without trailers, articulated lorry cabs, rigid goods vehicles pulling trailers, vehicles carrying exceptional loads, and haulage vehicles excluding showman's vehicles.

For a 44-tonne truck, the current annual VED stands at £1,643 for the 2025/26 period. During recent parliamentary scrutiny of the Finance Bill, Shadow Exchequer Secretary James Wild voiced concerns about the timing of these VED increases.

He highlighted the complexity of the existing system, noting that HGV car taxes already comprise more than 80 different rates based on weight, emissions, class and configuration.

He pointed to Road Haulage Association research estimating that fuel duty alone adds over £2,000 annually to operating a single HGV, translating to £435million in additional costs across the entire sector.

"The logistics industry pays a huge amount of fuel duty - it is a vital sector, which adds £170billion in gross value added and employs around eight per cent of the workforce," Mr Wild stated.

Meanwhile, Liberal Democrat MP Joshua Reynolds echoed these concerns, acknowledging that the haulage sector has faced "significant challenges" in recent years.

Mr Reynolds stated multiple pressures are confronting operators, including rising fuel prices, wage increases, changes brought by the Employment Rights Act 2025, business rates adjustments, and the vehicle excise duty increases under discussion.

He also drew attention to Brexit-related complications, citing examples from the Business and Trade Committee where goods moving to France required 29 different stamps on paperwork, with minor errors causing costly delays.

"If we add that to the £2,000 cost per truck of the changes to Vehicle Excise Duty, we see very clearly that the significant changes that the Government are making in quick succession are not helping the sector, which needs all the support it can get," Mr Reynolds said.

Treasury Exchequer Secretary Dan Tomlinson explained that VED rates depend on a vehicle's revenue weight, axle configuration and Euro emissions status, with the registered keeper responsible for payment.

LATEST DEVELOPMENTS

- Sadiq Khan could extend Congestion Charge hours as drivers use loophole to avoid paying daily fee

- Diesel is 'on the way down' as car market 'moves decisively towards electric vehicles'

- Petrol and diesel drivers get 'financially hit from every angle' as Labour fails to ease cost pressures

Beyond the VED changes, hauliers face staged fuel duty increases beginning September 1 this year, when an additional 1p per litre will be added, reversing the temporary 5p cut introduced in 2022.

Further rises of 2p per litre are also scheduled for December 1 and March 1 2027, with fuel duty then returning to RPI-linked increases from April 2027.

Responding to the concerns raised, Mr Tomlinson defended the Government's approach, stating that ministers are "providing stability" for the private sector following what he termed the "relatively chaotic approach" of the previous administration.

Mr Tomlinson indicated that the Government examines measures comprehensively, having done so ahead of the Budget, and would continue working with the Chancellor on tax policy in the run-up to the next Budget.

He noted that future tax changes would not come until the end of the year, allowing more time to consider issues in the round.

The minister rejected calls for a formal statement on the VED increases' impact, arguing that since the uprating aligns with inflation, rates remain unchanged in real terms for vehicle owners.

Mr Wild also raised concerns that the Government could be "stalling progress on decarbonisation," pointing to insufficient fiscal support for transitional fuels such as hydrotreated vegetable oil while battery and hydrogen technologies continue to develop.

Our Standards: The GB News Editorial Charter

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0