Budget 2025: Five tips to cut tax and boost savings in 2026

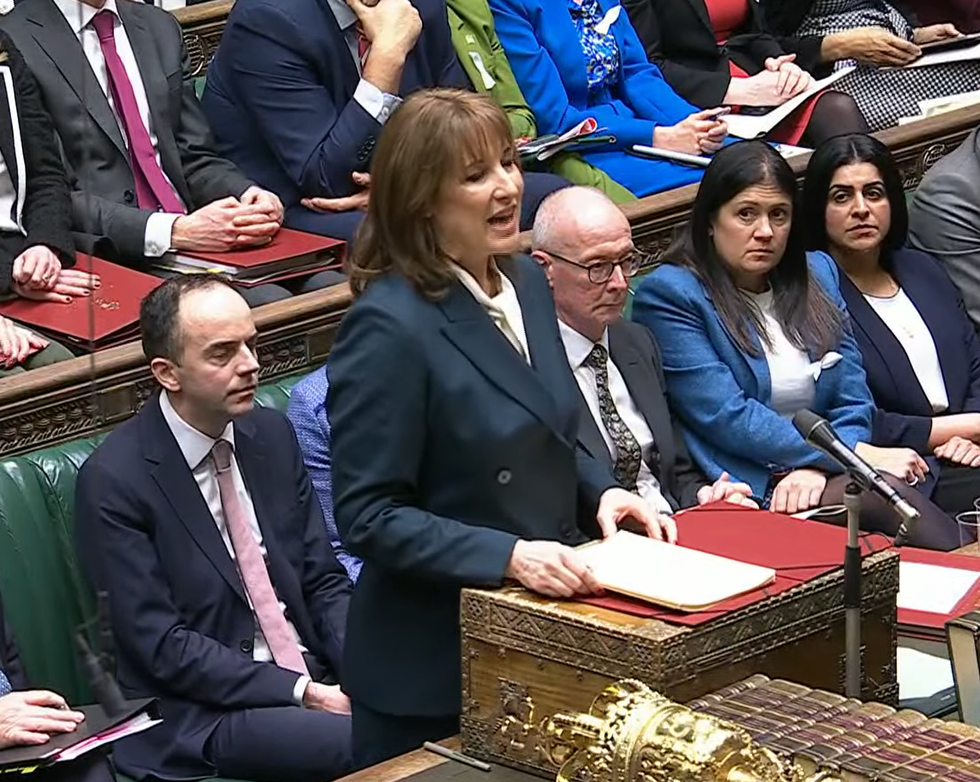

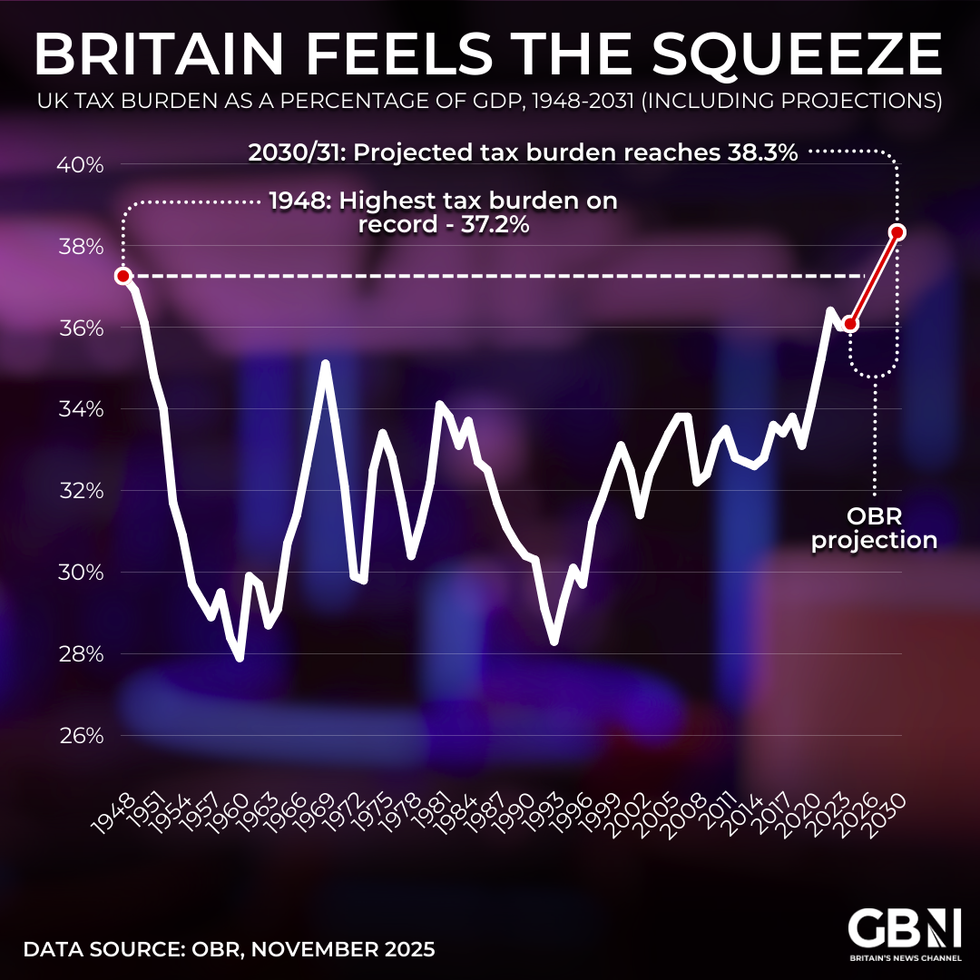

Chancellor Rachel Reeves sought to raise £26billion in tax receipts in the Budget, targeting pensioners, landlords and savers.

A financial planner has set out five resolutions he says could help people reassess their finances as 2026 approaches, following a year of shifting tax rules and rising living costs.

Adrian Murphy, the chief executive of Murphy Wealth, said most households now find their circumstances have changed significantly compared with 2024.

The five areas he outlines include reviewing personal finances after the Budget, beginning to invest, preparing for pension changes due in April 2027, taking a closer look at spending habits and making full use of tax allowances before they expire.

1.Reassess your position post-Budget

Many of the expected changes did not appear, noting that alterations to dividend tax, savings income and property income tax will take effect from April, but that most measures had been announced previously.

The next 18 months will look different for many people and he suggested evaluating how the changes will affect individual liabilities.

He said those already retired may want to reconsider how they structure their income, including looking at the pace of pension withdrawals, whether an annuity is suitable or whether to accelerate gifting to reduce the size of an estate.

2. Start dipping your toe into investing

Mr Murphy said many people rely heavily on cash savings and that those who regularly use their £20,000 ISA allowance may want to consider the markets.

He recommended gradually investing in low-cost and diversified funds to gain a better understanding of personal risk tolerance.

3. Prepare for pensions becoming part of your estate

The third resolution addresses pension rules that will bring pensions into estates for inheritance tax purposes from April 2027.

Mr Murphy described the change as one of the most significant shifts in financial planning in recent years and said it has prompted people to reconsider how they will pass on wealth.

He said some individuals have begun paying higher premiums for life insurance to help cover future inheritance tax bills for their families, with some policies reportedly costing as much as £1,000 per month.

He noted that the lack of new gifting restrictions in the Budget has encouraged some people to give more money to relatives earlier in life.

Mr Murphy said annuities could become more popular next year, with relatively high gilt yields making them more appealing for those nearing retirement.

He said annuities can offer secure income while reducing the value of an estate.

He also said there is a limitation, as annuities cannot be passed on, which may make them unsuitable for those primarily focused on inheritance planning.

LATEST DEVELOPMENTS

- Rachel Reeves raid REVEALED: Britons paying more income tax than French, shocking figures claim

- HMRC alert: Millions of workers urged to apply for tax help as January 2026 deadline looms

- Inheritance tax update: Rachel Reeves to push record number of estates into £1million bill

4. Take an honest look at your spending

Mr Murphy said rising living costs mean that budgets set one or two years ago may no longer reflect reality.

He said households should review their expenditure across categories such as food, clothing, housing and insurance to determine how much cash they need to keep readily available.

He recommended maintaining an emergency fund covering between three and six months of expenses.

5. Maximise your allowances and reliefs

Mr Murphy pointed out that the capital gains annual exempt amount has fallen from £12,300 to £3,000 in recent years.

He said households can make use of a £20,000 ISA allowance and can contribute up to £60,000 to a pension depending on income.

He noted that £1,000 in savings interest, £500 in dividends and £1,000 in property income are available tax-free on a use-it-or-lose-it basis.

Our Standards: The GB News Editorial Charter

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0